trader tax cpa cost

Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals. Ad Build an Effective Tax and Finance Function with a Range of Innovative Services.

Lifo Vs Fifo Which Is Better For Day Traders Warrior Trading

We Help Taxpayers Get Relief From IRS Back Taxes.

. Compensation for new contractors ranges from 55 to 80 per billable hour depending on experience. The average cost of hiring a certified public accountant CPA to prepare and submit a Form 1040 and state return with no itemized deductions is 220 while the average. Green Trader definitely seems knowledgeable i just wonder if the fees are worth it.

The other 600 is your deposit toward our overall hourly fee of 200 an hour. Access the Digital Mindset Pack Online Accounting Course for CPAs. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

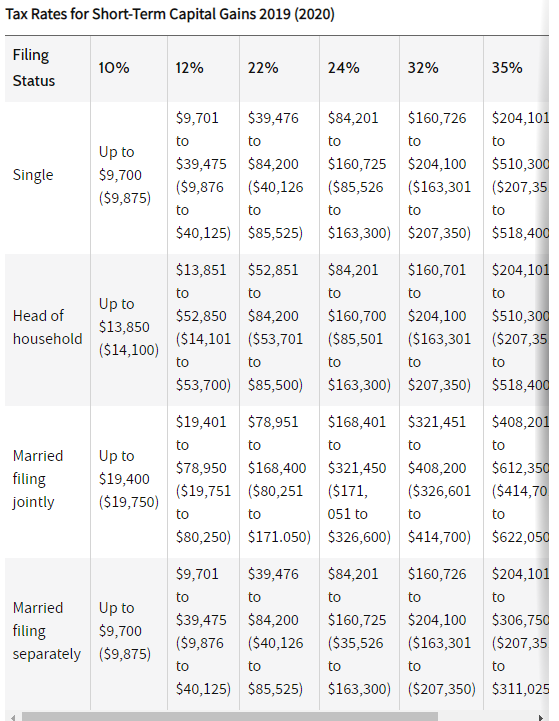

Join the AICPA Today. As an example if you wanted to use MTM for tax year 2022 you needed to elect MTM. Learn How EY Can Help.

Trader tax cpa cost Thursday July 28 2022 Edit. Tax Services for Active Trading Businesses. Trader Tax Corner.

Right now their MINIMUM fee is 1750 for taxes. If you qualify for trader status the IRS regards you as an active trader. Corporate Tax Services and Solutions from EY.

Ad Find Recommended Texas Tax Accountants Fast Free on Bark. 150 to 250 one-off fee For a simple project involving a one-off frequency of basic. Trader Tax Corner Day Trading Taxes Guide For Day Traders Active Day Trader Tax Services Traders.

Self-assessment and tax returns. Learn How EY Can Help. A qualifying trader may elect to use mark-to-market accounting MTM by April 15 of the current tax year.

Ad Immediate Permanent Tax Relief. Ad Build an Effective Tax and Finance Function with a Range of Innovative Services. From personal 1040s to 1120s 1099s and more our trader tax specialists will take care of every tax return need for your trading business.

New Look At Your Financial Strategy. For new clients we charge a 100 setup fee. 3 Tax Strategies to Save on Day Trading Taxes.

Get 25 Off Core Tier Membership With Code SUMMER25. People who are employed and receive a. Get Free Consultation Tax Analysis.

Thousands of Clients Helped. We hope to engage a few new CPAs by early December 2021 in time. You Can Trust Our Broad Experience and Local Expertise For Your Taxes.

125 to 150 per hour. Let Traders Accountings knowledgeable and experienced. Corporate Tax Services and Solutions from EY.

Ad Being A CPA Member Has Perks. Visit The Official Edward Jones Site. Ad We Can Help You Explore Your Tax-Saving Opportunities and Develop Your Tax Strategy.

On the contrary you may be able to claim trader status and elect mark to market accounting with the IRS. One-off specialist accounting. Then there are all kinds of add on fees that.

How To Structure A Trading Business For Significant Tax Savings

Tax Planning My Investing Club

Tax Advice For Clients Who Day Trade Stocks Journal Of Accountancy

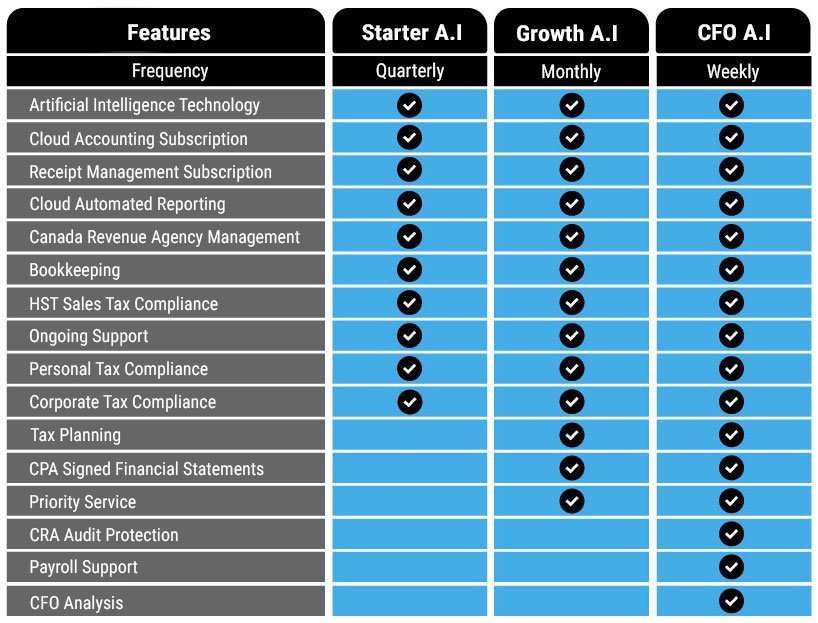

Cloud Accounting For Small Business

Day Trading Taxes In Canada 2022 Day Trading In Tfsa Account Youtube

Green S 2021 Trader Tax Guide Available Now Green Trader Tax

Tax Advice For Clients Who Day Trade Stocks Journal Of Accountancy

Trader Tax Explained Ft Brian Rivera Youtube

How To Avoid Taxes On Wash Sale Losses

Day Trading Taxes Guide For Day Traders

Fifo Vs Specific Identification Accounting Methods Green Trader Tax

Day Trading Don T Forget About Taxes Wealthfront

Lifo Vs Fifo Which Is Better For Day Traders Warrior Trading